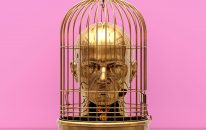

What is Sweat Equity and is it worth having?

This is a term that’s quite often used in Start-Up land.

In most cases it’s fundamentally a technical/financial vehicle that allows an owner (entrepreneur) to get access to resources to help them build and drive the business in its early days, without having to pay cash for them. Instead, or in-lieu of cash, resources (read: employees) are offered equity (share ownership) for the time that they spend on the project.

So, in most employer/employee relationships any ‘sweat’ involved is compensated for with salary, but in this case it’s compensated for with company ownership.

I’ve seen quite a few of these scenarios and there are pros and cons for all involved. If they’re handled well and the owner has a fair and moral outlook, then this can be a great way to build a business. However, I’ve seen situations where any resources involved are, more or less, exploited, worked hard and then end up with nothing.

Health Warning; this venture may be worthless!

The first thing to realise about a business that requires resources for sweat equity is that there’s a fair amount of risk involved. There’s a reasonable chance that this business may not make it out of Start-Up mode and that your resultant equity may therefore be worthless.

So, the first rule for Sweat Equity is not to get your hopes up that this venture will ultimately have real value, and don’t invest more time in it than you can realistically afford to. Box off that time and think of it as a ‘punt’ that may turn out to be something more valuable down the road.

Understand the funding or cashflow plan

The whole point of Sweat Equity for the business owner is to start to build something that allows the business to grow and ultimately create value/cash. If the plan is to raise money (as compared to generating cash through sales) then, if you’re being asked to put time and effort in for equity, it’s more than reasonable for you to ask the owner what the plan is for funding, how much is being raised, how long is it expected to take, and when it will be completed.

If you’re not convinced that this plan is strong enough or if the timescales are too long, then perhaps you should consider body-swerving this opportunity. A lack of clear understanding here from the owner won’t fill you with confidence.

Get your equity agreement in place on day one

Before you get your hands dirty, you need to understand the exact value of the effort that you’re putting in when compared to everyone else. This will create a baseline for you to understand the ultimate value of this equity to the business in pro-rata terms.

For example, if you intend to spend 6 months working on this project, and will spend circa 20 hours a week on it (roughly half a working week), then this is the equivalent of 3 months full-time. How much would you expect to be paid normally for this using market rates? This, in cash terms then, is the value of your sweat equity investment.

Your negotiation with the owner should allow you to have an open conversation about all the sweat equity being provided and therefore how yours stacks up against the total, as this proportion should be the equity that you ultimately own.

By way of further example, if your contribution was £25,000 and the total contribution was £250,000 (including you), then you should own 10% of the business when all is said and done. Don’t let anyone convince you that your time isn’t as valuable as anyone else’s. It is. If your skills are needed, then you deserve your fair share of what is a high-risk project where the chances of success are low.

Be prepared to receive your equity as Options

It makes a lot of sense for an owner to provide equity to prospective resources via Share Option agreements. This is because, how a relationship begins may not be how it ends. If they agree to give you 10% equity in the business and you either, don’t show up, or can’t do what you say you can, then they need a failsafe mechanism to prevent them losing equity for no reason.

So, instead you’re likely to receive your equity in a Share Option agreement where the agreed equity will ‘vest’ after a period of time assuming that you do what you’ve agreed to. These agreements are usually quite straightforward but can be biased towards the owner (somewhat understandably).

However, it’s important that you don’t allow the agreement to put too long a timescale on the equity becoming yours. I’ve seen them with vesting periods that can last up to 3 years and this is just unfair on resources. This is primarily because, if things take too long and you decide to move on, you’ll likely receive nothing for all your time spent just because the project took much longer to come to fruition than was originally projected. This is not your fault.

So, while agreeing to have your shares provided by way of Share Options, aim to have your shares vest in months. It’s also very important that these shares have a very low ‘strike price’ (i.e. the price you’ll have to pay for them to exercise them). Not only is this possible because the business will have a very low valuation at this point, it’s also the fairest thing to do. I’ve seen owners put strike prices on options of hundreds of dollars per share for resources who simply didn’t know any better. This is exploitative, unreasonable and unfair.

Put a timescale on your involvement

Businesses is this mode will always have optimistic views of where they will be in a short period of time (say 6 -12 months). However, it’s extremely hard to predict where things will go in the short to medium term as it’s still growing. Small changes can effect start-ups significantly. Also, how many sweat equity staff does the business need to execute its plan? Can it attract them?

Either way, it makes sense for you to manage the expectations of the owner by setting a timescale in any employment contract that you sign by putting a confirmed end date on it. You can always decide to extend it if you wish, but this way you’re in control. It also puts a little more pressure on the owner to deliver what they said they would in the timescales agreed.

Do what you said you would do

If the owner has agreed terms with you and you’ve signed an agreement for options and an agreement to get involved, you need to show up.

These are tricky circumstances for owners to manage and they ultimately spend a lot of time and energy speaking to candidates that don’t want to get involved when they fully understand that there’s no cash on the table in the immediate future.

So, if you’ve committed, come to the party ready to work and help them make a difference as you all enjoy the ride.

Many times I’ve seen enthusiastic newbies sign all the agreements and then realise that they don’t have the time, or it’s harder than they thought, or just that the novelty wears off really quickly. Don’t be one of these people. Do it or don’t do it, but don’t waste the team’s time by not supporting them when they need you.

That said, if you’ve been there a while and you don’t like what you see, then don’t be afraid to walk away either. This is your time you’re giving here and if you feel that it could be better spent elsewhere then say so and let them get on with their project without you.

Under these circumstances, the way Share Option agreements work is that you’ll be unlikely to own any shares if you walk early, but that’s fair, as you didn’t complete your end of the bargain.

In summary

Start-ups are risky places to be, but they can also be a lot of fun! If you can afford to spend some time in one for the experience and to give your time as Sweat Equity then I would highly recommend it. But, you need to understand how the game works so you can make sure that you’re treated fairly for the time you spend.

Once you’ve done it a few times you’ll know a good opportunity when you see one and it’ll be pretty easy to understand whether you want to get involved or not.

Take a punt and enjoy the ride, but watch out for the sharks!

Thanks

E